Notifications

Posted by - News Editor![]() \

\

Feb 13 \

Filed in - Business \

Hollywood Warner Brothers David Ellison Paramount \

185 views \ 0 comments \ 0 likes \ 0 reviews

Dfox Biz:

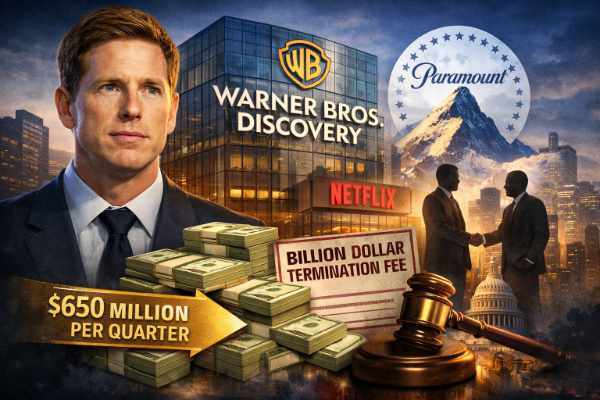

Ellison Intensifies Pursuit of Warner Bros. Discovery as Paramount Adds Financial Incentives

The contest for control of Warner Bros. Discovery is escalating, as producer and media executive David Ellison has intensified efforts to acquire the company, supported by new financial incentives designed to reassure shareholders amid regulatory uncertainty and competing strategic deals.

In the latest developments, Paramount has proposed a substantial quarterly payment to Warner Bros. Discovery shareholders, reportedly structured to begin next year if a transaction is delayed by regulatory review. Such “ticking fees” are increasingly used in large mergers to compensate investors when approvals take longer than expected, a realistic concern in complex media and technology transactions that often face extended antitrust scrutiny.

Paramount has also signaled a willingness to absorb a significant termination fee should Warner Bros. Discovery withdraw from an existing agreement tied to a major streaming partnership. Covering that obligation would remove one of the largest financial barriers to changing course, potentially making a revised ownership structure more attractive to investors weighing both risk and long-term value.

Warner Bros. Discovery’s management has previously resisted takeover approaches and continued to support its current strategic direction, emphasizing stability and the long-term potential of its content library, studio operations, and streaming assets. However, the current effort is widely viewed as a hostile bid, meaning shareholders—rather than company leadership alone—could ultimately determine the outcome if a formal vote proceeds.

Industry analysts note that the stakes extend far beyond a single corporate transaction. Warner Bros. Discovery remains one of the world’s largest entertainment companies, with extensive film, television, and digital distribution holdings. Any change in ownership could significantly influence the competitive balance among major studios and streaming platforms, particularly as consolidation and partnerships reshape the global media landscape.

A special shareholder meeting is expected in the coming weeks, and investors will be closely watching both financial terms and regulatory developments. The decision could shape not only the future of Warner Bros. Discovery but also the broader direction of the entertainment industry in the years ahead.

"DesertFox is an exclusive, invitation-only network where high achievers, innovators, and visionaries connect. As a premier global community, we bring together individuals from diverse backgrounds to collaborate, create, and inspire. While our platform is visible to the public, only our select members can engage, ensuring a high-end experience where connections drive impact, creativity thrives, and opportunities are limitless."

Comments